|

My intent in redesigning this page is to break

out the health care reform issue into topic

areas, i.e., PPACA (the Patient

Protection and Affordable Care Act); covering

the uninsured and universal health care;

quality; costs; and specific reforms like

managing managed care, accounting for care,

rationing care, and the like, and to sort the

resources and discussion into topic areas for

easier retrieval.

contents…

Patient Protection

and Affordable Care Act

Let Sleeping Gorillas Lie: Setting the Benefit Rules Under PPACA

Quality Matters

Where Does the United States REALLY Rank Among

Nations When it Comes to Health Care?

Does the U.S. have too few physicians, or too few primary care

practitioners?

Cost Controls

Everything You Ever Wanted to Know About the

PPACA Independent Payment Advisory Board But

Were Afraid to Ask

Buried in PPACA (Obamacare) is a secret weapon

to contain Medicare costs... the IPAB. Meet

the group of House Democrats who want to

destroy it.

The Independent Payment Advisory Board Under Fire: Can Its Opponents

Succeed in Killing It? The Independent Payment Advisory Board Under Fire: Can Its Opponents

Succeed in Killing It?

Payment Changes and

Reforms

Everything You Ever Wanted to Know About the

PPACA Independent Payment Advisory Board But

Were Afraid to Ask

Financing Changes,

Taxes and Premiums

Means-Testing Medicare: The rich have been

getting richer. Should they should pay more? Or

get less?

The Budgetary Impact of the New Health Care

Reform Law Over 10 Years and Beyond

Health Care is Now 17.6% of the Nation's

Gross Domestic Product

U.S. Taxpayers are

Over-Taxed... Not! ...(when compared to

other industrialized nations; we're just not

getting what we pay for)...

PPACA

Truths, Lies and Distortions

The Biggest and Baddest Lies about PPACA

("Obamacare")

Is PPACA a "Job-Killing, Budget-Busting Law?"

Not According to the Facts.

Repeal of PPACA is the REAL Job-Busting

Action

Covering the

Uninsured and Underinsured

Mini-Med ... and the Underinsured Mini-Med ... and the Underinsured

Let's Just Allow

the Buying of Health Insurance Across State

Lines, That's the Ticket, Cheaper Insurance...

NOT! Another Failed TeaParty/GOP Idea

Insurance Across State Lines: Sounds

Good... on Paper ... But Consider the

Real Impact ... And Besides it Does NOTHING to

Solve Insurance Affordability and at Best Might

Get Another 4 Million Insured... A Drop in the

Bucket

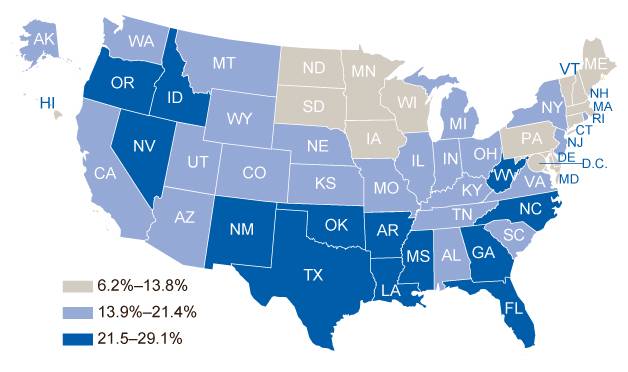

The Nation's Uninsured (as seen by the Centers for Disease Control) The Nation's Uninsured (as seen by the Centers for Disease Control)

Gosh Darn All

Those Pesky Uninsured People...

Rationing

Let's Kill Granny! Health Care Rationing For Me

But Mostly You...

Changing How Health

Care is Delivered

Too Many Doctors? Too Few Nurses!

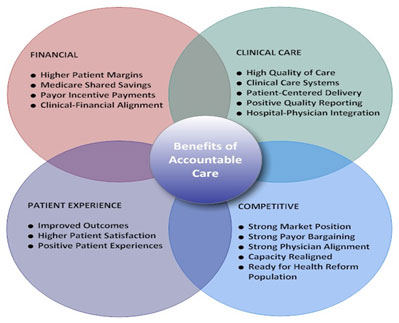

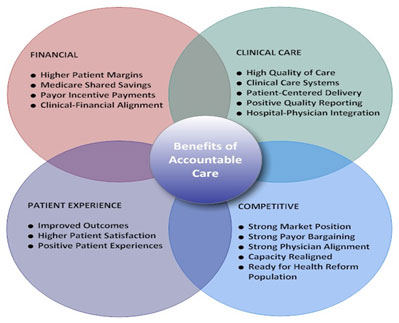

Taming the Unicorn: Accounting for Accountable

Care Organizations (ACOs)

ACCOUNTABLE CARE ORGANIZATIONS: New Rules

Soon... Very Soon

... and after

reviewing any of these "thoughts," you are

offended or challenged... or maybe you just want

to go into it a bit more, drop Jeanne an e-mail

and open the dialog:

jeanne.matthews@health-politics.

... and things only tangentially-related to

health care ...

The Pope hates nuns because ...

Where Does the United States REALLY Rank Among

Nations When it Comes to Health Care?

The famous (or is it infamous) World

Health Organization survey of 1998-99, ranked the United States 37th

in the world when it came to the overall effectiveness of its health

care system, just two places ahead of Cuba and one behind Costa Rica

(see chart below)

|

1 France |

66 Hungary |

131 Honduras |

|

2 Italy |

67 Trinidad and Tobago |

132 Burkina Faso |

|

3 San Marino |

68 Saint Lucia |

133 Sao Tome and Principe |

|

4 Andorra |

69 Belize |

134 Sudan |

|

5 Malta |

70 Turkey |

135 Ghana |

|

6 Singapore |

71 Nicaragua |

136 Tuvalu |

|

7 Spain |

72 Belarus |

137 Ivory Coast |

|

8 Oman |

73 Lithuania |

138 Haiti |

|

9 Austria |

74 St. Vincent- Grenadines |

139 Gabon |

|

10 Japan |

75 Argentina |

140 Kenya |

|

11 Norway |

76 Sri Lanka |

141 Marshall Islands |

|

12 Portugal |

77 Estonia |

142 Kiribati |

|

13 Monaco |

78 Guatemala |

143 Burundi |

|

14 Greece |

79 Ukraine |

144 China |

|

15 Iceland |

80 Solomon Islands |

145 Mongolia |

|

16 Luxembourg |

81 Algeria |

146 Gambia |

|

17 Netherlands |

82 Palau |

147 Maldives |

|

18 United Kingdom |

83 Jordan |

148 Papua New Guinea |

|

19 Ireland |

84 Mauritius |

149 Uganda |

|

20 Switzerland |

85 Grenada |

150 Nepal |

|

21 Belgium |

86 Antigua-Barbuda |

151 Kyrgystan |

|

22 Colombia |

87 Libya |

152 Togo |

|

23 Sweden |

88 Bangladesh |

153 Turkmenistan |

|

24 Cyprus |

89 Macedonia |

154 Tajikistan |

|

25 Germany |

90 Bosnia-Herzegovina |

155 Zimbabwe |

|

26 Saudi Arabia |

91 Lebanon |

156 Tanzania |

|

27 United Arab Emirates |

92 Indonesia |

157 Djibouti |

|

28 Israel |

93 Iran |

158 Eritrea |

|

29 Morocco |

94 Bahamas |

159 Madagascar |

|

30 Canada |

95 Panama |

160 Vietnam |

|

31 Finland |

96 Fiji |

161 Guinea |

|

32 Australia |

97 Benin |

162 Mauritania |

|

33 Chile |

98 Nauru |

163 Mali |

|

34 Denmark |

99 Romania |

164 Cameroon |

|

35 Dominica |

100 Saint Kitts & Nevis |

165 Laos |

|

36 Costa Rica |

101 Moldova |

166 Congo |

|

37

United States of America |

102 Bulgaria |

167 North Korea |

|

38 Slovenia |

103 Iraq |

168 Namibia |

|

39 Cuba |

104 Armenia |

169 Botswana |

|

40 Brunei |

105 Latvia |

170 Niger |

|

41 New Zealand |

106 Yugoslavia |

171 Equatorial Guinea |

|

42 Bahrain |

107 Cook Islands |

172 Rwanda |

|

43 Croatia |

108 Syria |

173 Afghanistan |

|

44 Qatar |

109 Azerbaijan |

174 Cambodia |

|

45 Kuwait |

110 Suriname |

175 South Africa |

|

46 Barbados |

111 Ecuador |

176 Guinea-Bissau |

|

47 Thailand |

112 India |

177 Swaziland |

|

48 Czech Republic |

113 Cape Verde |

178 Chad |

|

49 Malaysia |

114 Georgia |

179 Somalia |

|

50 Poland |

115 El Salvador |

180 Ethiopia |

|

51 Dominican Republic |

116 Tonga |

181 Angola |

|

52 Tunisia |

117 Uzbekistan |

182 Zambia |

|

53 Jamaica |

118 Comoros |

183 Lesotho |

|

54 Venezuela |

119 Samoa |

184 Mozambique |

|

55 Albania |

120 Yemen |

185 Malawi |

|

56 Seychelles |

121 Niue |

186 Liberia |

|

57 Paraguay |

122 Pakistan |

187 Nigeria |

|

58 South Korea |

123 Micronesia |

188 Dem. Rep. of Congo |

|

59 Senegal |

124 Bhutan |

189 Cent. African Republic |

|

60 Philippines |

125 Brazil |

190 Myanmar |

|

61 Mexico |

126 Bolivia |

|

|

62 Slovakia |

127 Vanuatu |

|

|

63 Egypt |

128 Guyana |

|

|

64 Kazakhstan |

129 Peru |

|

|

65 Uruguay |

130 Russia |

|

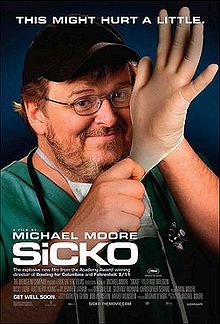

And while the survey upon which these

rankings were give is now more than a dozen years old ... and subject

to considerable crit icism

and debate. it is still the one most commonly cited by most media

outlets and so-called health care gurus, including such celebrities as

Michael Moore in his award-winning documentary, "SiCKO." Another

such guru, one Jeanne Scott Matthews, has (in the past) used these

rankings often in her writings and presentations. But it is time to

admit that this survey and these rankings are

no longer meaningful and have become deceptive in both use

during the health care debate and in drawing any conclusions about the

U.S. health care system.

I hereby pledge to nevermore use this chart or these numbers. icism

and debate. it is still the one most commonly cited by most media

outlets and so-called health care gurus, including such celebrities as

Michael Moore in his award-winning documentary, "SiCKO." Another

such guru, one Jeanne Scott Matthews, has (in the past) used these

rankings often in her writings and presentations. But it is time to

admit that this survey and these rankings are

no longer meaningful and have become deceptive in both use

during the health care debate and in drawing any conclusions about the

U.S. health care system.

I hereby pledge to nevermore use this chart or these numbers.

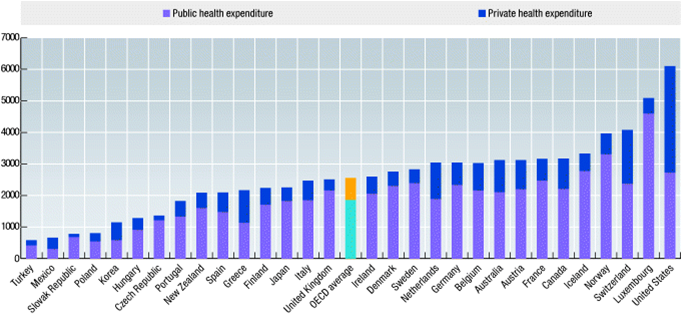

So how can we to evaluate the quality,

effectiveness and standing of U.S. health care in relation to the rest

of the world, and in particular to other industrialized nations with

whom we compete economically in world markets?

How much we spend and what we are getting in

return for our money are increasingly important measures impacting

this nation's future competitiveness and will play a critical part in

resolving our country's economic woes and budgetary problems.

One thing we cannot do, is stay in place and do nothing.

There are a number of newer... and

apparently more reliable surveys to be considered. One is the regular

rankings from the Organisation for Economic Cooperation and

Development (OECD)

|

The Organisation for European Economic Cooperation (OEEC) was

established in 1947 to run the US-financed Marshall Plan for

reconstruction of a continent ravaged by war. By making individual

governments recognise the interdependence of their economies, it

paved the way for a new era of cooperation that was to change the

face of Europe. Encouraged by its success and the prospect of

carrying its work forward on a global stage, Canada and the US

joined OEEC members in signing the new OECD Convention on 14

December 1960.

The Organisation for Economic Co-operation and Development

(OECD) was officially born on 30 September 1961, when the

Convention entered into force. Other countries joined in,

starting with Japan in 1964. Today, 34 OECD member countries

worldwide regularly turn to one another to identify problems,

discuss and analyse them, and promote policies to solve them. The

track record is striking. The US has seen its national wealth

almost triple in the five decades since the OECD was created,

calculated in terms of gross domestic product per head of

population. Other OECD countries have seen similar, and in some

cases even more spectacular, progress.

So, too, have countries that a few decades ago were still only

minor players on the world stage. China, India and Brazil have

emerged as new economic giants. Most of the countries that formed

part of the former Soviet bloc have either joined the OECD or

adopted its standards and principles to achieve our common goals.

Russia is negotiating to become a member of the OECD, and we now

have close relations with Brazil, China, India, Indonesia and

South Africa through our “enhanced engagement” programme. Together

with them, the OECD brings around its table 40 countries that

account for 80% of world trade and investment, giving it a pivotal

role in addressing the challenges facing the world economy. |

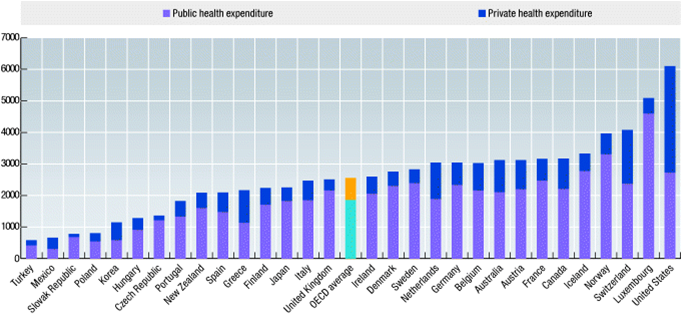

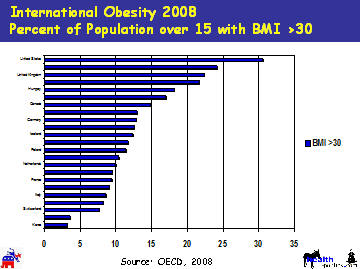

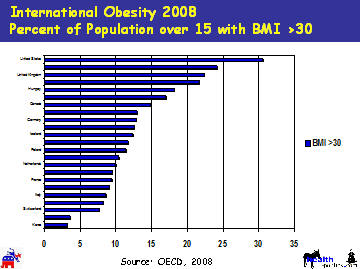

According to the OECD. the United States

ranks well down the list of the 34 counties in virtually every health

indicator category... well except for a couple.

We spend more per capita than any other

OECD country, by a lot:

Americans are more obese on average than

people in other OECD countries. (For the record, I contribute more

than my fair share to this record):

But there is one, new and VERY interesting ranking,

this from the Gallup people, and using "survey" results obtained from

"in person" interviews using standard statistical and polling

mechanisms. While "polling" is still not an exact science, its

methodologies have improved significantly. The Gallup people have also

introduced some "touchy-feely" aspects to their rating system...

"thriving," "struggling," "suffering," In this survey the

U.S. ranks considerably higher but still lags all of the Scandinavian

countries and our English-speaking "sister" British-descendant

nations, Australia, New Zealand and Canada, but ahead of continental

Europe.

Gallup Global Wellbeing Index by Country 2010

Countries Ranked by % Thriving

Gallup’s global wellbeing metrics are the first comprehensive

measure of the behavioral economics of gross national wellbeing, which

lays the foundation for all other measures of a country’s economic

strength. With ongoing research projects in more than 150 countries,

Gallup is a leader in the collection and analysis of global data and

measurements.

Gallup asks ordinary individuals for their thoughts and opinions on

several topics, including economics, religion, migration, and

wellbeing. Gallup’s data provide sound evidence on many issues that

more than 98% of the world’s adult population faces.

The table shows life evaluation estimates of the percentage

“thriving,” “struggling,” and “suffering” in countries and regions

across the world. Gallup’s Thriving, Struggling, and Suffering indexes

measure respondents’ perceptions of where they stand now and in the

future. Based on the Cantril Self-Anchoring Striving Scale, Gallup

measures life satisfaction by asking respondents to rate their present

and future lives on a “ladder” scale with steps numbered from 0 to 10,

where “0” indicates the worst possible life and “10” the best possible

life. Individuals who rate their current lives a “7” or higher and

their future an “8” or higher are considered thriving. Individuals are

suffering if they report their current and future lives as a “4” or

lower. All other individuals are considered struggling.

The table also includes daily wellbeing averages (0-10 scoring) based

on responses to 10 items measuring daily experiences (feeling

well-rested, being treated with respect, smiling/laughter,

learning/interest, enjoyment, physical pain, worry, sadness, stress,

and anger). Each daily experience is scored dichotomously with higher

scores representing better days (more positive and less negative daily

experience or affect).

*Limited urban samples only.

Means-Testing Medicare: The rich have been

getting richer. Should they should pay more? Or

get less?

One of the more recent phenomenon’s of my advanced years has been how

readily (and easily) I may change some of my most intense and deeply

held political beliefs. I’ve already cited my change in philosophy

regarding the

percent

of GDP spent on health care; now I am re-visiting Medicare

means-testing. It’s kind of like that old Samuel Clemens/Mark

Twain adage, “When I was young, my father was the most stubborn,

mule-headed, son-of-a-bitch, I had ever seen. But now that I am older,

it’s amazing how much smarter he has gotten.” But in my

case, my personal mule-headedness may only date to my 50’s, and my

smarter(ness) seems to have come in my late 60’s. <sigh>

Back before the turn of the century, I wrote (and spoke regularly)

about the issue of means-testing Medicare, rejecting the concept as a

sell-out to the original egalitarian principles of both Medicare and

its big sister, Social Security. These two benefit programs had

become an integral part of the

social contract that bound the

nation together. Every citizen who met the minimum qualifications

would be eligible; the bag-lady who sleeps over the grating outside

Union Station in Washington DC would get them, Bill Gates would get

them. The programs were completely egalitarian.

Way, way back in April 1999, in my regular monthly column in the Journal of the

Healthcare Financial Management Association, I wrote about,

"Changing the Medicare Social Contract" I first began to

discuss the potential for "means-testing Medicare. Back then, the

driving issue was a GOP-majority report

from

one of the seemingly unlimited “Medicare commissions” that suggested

something labeled: “premium support.”

Under a

premium support model, Medicare would credit each eligible beneficiary

with an equal allocation, an amount currently estimated to be 88

percent of the average per capita amount Medicare spends. Based on the

then available 1998 expenditures, this amount would have been

approximately $4,994 (88 percent of the $5,675 a year HCFA (now CM2)

then said it was paying per beneficiary for Part A and Part B

Medicare). Future Medicare allocations would have been adjusted yearly

based on actual expenditures and budgetary decisions. Premium

support advocates (mostly Republican) were seeking to "penalize" those

who might choose a more expensive plan by reducing their 88 percent

allocation while raising the allocation for lower-income individuals.

In effect, under the plan, Medicare beneficiaries would be subject to

means testing, thus transforming Medicare into a multitiered social

benefits program with all of the trappings of a full-fledged welfare

program.

Welfarizing Medicare (and Social

Security)

Now welfare-like provisions have been creeping into

Medicare and Social Security for some time. We have begun taxing the

Social Security benefits of retirees with retirement incomes greater

than $35,000 a year - in effect, taking back from the "wealthy" some

of their "entitlement" to the full benefits of that program.

Similarly, under Medicare, by subjecting every dollar of income to the

Medicare tax with no increase in benefits, the wealthier have been

paying more for their coverage for the past several years and

effectively subsidizing poorer people who pay less. In 2003, with the

passage of the Medicare Modernization Act (the law that gave us

Medicare Part D, prescription drugs) we began the most direct

means-testing of Medicare, increasing the monthly Medicare Part B

premium for those with incomes over $80,000 a year. At the time

Democrats were unalterably opposed to this, holding fast to

their egalitarian views. The prescription drug benefit provisions in

the 2003 MMA (I prefer the acronym "NAIM")

got all the attention but other changes to Medicare may end up having

far more long term impact... mostly specifically the establishment of

new Medicare Part C, the 2003 version of "premium support." For the

first time, we tiered Medicare directly, with wealthier individuals

paying higher monthly premiums, ranging from 20% to 100% more, on a

rising scale.

Democrats went postal at the time and the new law was

passed without a single Democratic vote. The Democrats fought the

"welfarization" of Medicare, fearing that in the long term, as merely

another "welfare" program, the entitlement nature of the program would

change forever, and with it, as the tides of time and change moved,

would public support for the program.

But I am not the only one getting smarter in my old

age, by 2010, in PPACA, Democrats had come virtually full circle on

the means-testing issue and almost eagerly added a means test of their

own, extending the GOP-driven rising scale of premiums for Medicare

Part B to Medicare Part D. Will Medicare Part A be next?

As an interesting side fact, a survey showed that by

2008, that Democrats favored means-testing Medicare at a statistically

higher rate than Republicans. You can draw your own conclusions about

that, but egalitarian attitudes toward Medicare (and,

presumably Social Security, would be appear to have died a slow and

apparently not too painful Democratic mind-set death.

Changing the Social Contract

The

egalitarian philosophy that was so much a part of Medicare in the

beginning - that all Americans are entitled to receive Medicare simply

because they are Americans -- is breaking down. Not that there's

anything wrong with that. Social contracts can be changed as long as

the American electorate understands and agrees to the change. But

therein lies a very irritating rub, the Social Contract, is being

changed secretly, incrementally without the understanding "advice and

consent" of the people. The

egalitarian philosophy that was so much a part of Medicare in the

beginning - that all Americans are entitled to receive Medicare simply

because they are Americans -- is breaking down. Not that there's

anything wrong with that. Social contracts can be changed as long as

the American electorate understands and agrees to the change. But

therein lies a very irritating rub, the Social Contract, is being

changed secretly, incrementally without the understanding "advice and

consent" of the people.

The idea of "privatizing" Medicare as pushed by

today's TeaParty/GOPers should be a non-starter. They would

essentially gut the entire program (albeit, as explained me by one of

the "pool people" in my senior 55+ community in Arizona, "I know it

would ultimately destroy Medicare, but it'll take them years to

implement. By then I will be gone and won't worry about it.) She is an

enthusiastic TeaParty/GOPer. But we do need to look at ways where

means-testing may benefit not just the low to middle income

beneficiaries of today, but those of tomorrow as well. We do need to

couple any such mans-testing with major payment reforms and delivery

changes. Gosh for an old lady, I have a lot of work to do.

back to

top

Is PPACA a "Job-Killing, Budget-Busting Law?"

Not According to the Facts.

When

it comes to truth in labeling, House

Republicans are getting off to a poor start

with their constantly repeated references to

the new health care law as "job-killing." When

it comes to truth in labeling, House

Republicans are getting off to a poor start

with their constantly repeated references to

the new health care law as "job-killing."

The Facts:

-

Independent, nonpartisan experts

project only a "small" or "minimal" impact on

jobs, even before taking likely job gains in

the health care and insurance industries into

account.

-

The House Republican leadership,

in a report issued January 6, badly

misrepresents what the Congressional Budget

Office has said about the law. In fact, CBO is

among those saying the effect "will probably

be small."

-

The GOP also cites a study

projecting a 1.6 million job loss — but fails

to mention that the study refers to a

hypothetical employer mandate that is not part

of the new law.

-

The same study cited by the GOP

also predicts an offsetting gain of 890,000

jobs in hospitals, doctors’ offices and

insurance companies — a factor not mentioned

by the House leadership.

There’s little doubt that the new

law will likely lead to somewhat fewer low-wage

jobs. That’s mainly because of the law’s

requirement that, generally, firms with more

than 50 workers pay a penalty if they fail to

provide health coverage for their workers. One

leading health care expert, John Sheils of The

Lewin Group, puts the loss at between 150,000

and 300,000 jobs, at or near the minimum wage.

And Sheils says that relatively small loss would

be partly offset by gains in the health care

industry.

Analysis

Attaching misleading labels to

legislation is a well-worn tactic in

Washington. Conservatives got rid of most of

the estate tax after labeling it a "death

tax," as though it taxed death instead of

multimillion-dollar fortunes. And liberals

once won passage of an "assault weapons ban"

that didn’t really ban fully automatic

military assault rifles, which were already

illegal for civilians to own without a

very-hard-to-get federal license. Now House

Republicans are seeking to repeal what they

call "Obamacare:

A budget-busting, job-killing health care

law." That’s the title of a study issued

by the House Republican leadership

January 6.

And the GOP is clearly pushing the

"job-killer" claim. House Speaker John Boehner

used the phrase "job-killing" to describe the

health care law seven times on Thursday in

a press conference that lasted less than 14

minutes — that’s once every 2 minutes. He also

used the phrases "destroy jobs" and "destroying

jobs" once each when talking about the law.

Perhaps not surprisingly, the Republicans named

their

bill to repeal the health care law:

"Repealing the Job-Killing Health Care Law Act."

But is the

health care law really "job-killing" as claimed?

That's just another case of exaggerated and

misleading labeling.

Job-Killing?

To support

its claim, the GOP report first cites the

nonpartisan Congressional Budget Office — but

the report badly misrepresents what CBO actually

said.

House GOP Leadership, January 6: The

health care law will cause significant job

losses for the U.S. economy: the Congressional

Budget Office has determined that the law will

reduce the “amount of labor used in the

economy by … roughly half a percent…,” an

estimate that adds up to roughly 650,000 jobs

lost.

In fact,

CBO did not predict a 650,000 job loss. The

Republican report cites

a CBO report from August, which actually

said that the economy will use less labor

primarily because many people will choose to

work less, or retire early, as a result of the

new law. What CBO projects is mostly a

reduction in the supply of labor, which is not

the same as a reduction in the supply of jobs.

CBO, August 2010: The Congressional

Budget Office (CBO) estimates that the

legislation, on net, will reduce the amount of

labor used in the economy by a small

amount—roughly half a percent—primarily

by reducing the amount of labor that workers

choose to supply.

CBO said

one reason fewer people will choose to work is

that many low-income people will have more money

in their pockets as a result of the law

expanding Medicaid and providing federal

subsidies for many who buy insurance privately.

"The expansion of Medicaid and the availability

of subsidies through the exchanges will

effectively increase beneficiaries’ financial

resources," CBO said. "Those additional

resources will encourage some people to work

fewer hours or to withdraw from the labor

market."

Another

reason that people might work less is that the

new law requires insurance companies to cover

preexisting conditions, and also limits their

ability to charge higher rates for older persons

who buy policies for themselves. "As a result,

some older workers will choose to retire earlier

than they otherwise would," CBO said.

To be

sure, some jobs will indeed be lost, CBO said.

That’s because the new law requires many

businesses to pay a penalty if they do not

provide health insurance to their workers. That

"will probably cause some employers to respond

by hiring fewer low-wage workers," CBO said. But

it also said these firms may hire more part-time

or seasonal workers instead. CBO did not

estimate the number of jobs likely to be

affected either way.

In a more

extensive look at the subject,

CBO on July 14, 2009, said the effect of the

employer mandate "would probably be small."

The GOP report did not mention that.

Finally,

CBO did not attempt to estimate the number of

jobs likely to be gained in the health care and

insurance industries. It has projected that the

law will result in 32 million Americans gaining

health insurance that they would not otherwise

have, enabling them to buy more services from

physicians and other health care providers. More

about that later.

Others Estimate ‘Small,’ ‘Minimal’ Impact

The Lewin

Group also has estimated a small impact on jobs

as a result of the health care law. Senior Vice

President John Sheils said Lewin’s analysis

showed 150,000 to 300,000 jobs lost, all minimum

wage or near minimum wage positions that would

be lost permanently. That doesn’t account for

increases in jobs in other sectors, mainly

health care, that Sheils also expects but hasn’t

quantified. All told, he estimates, a "small net

job loss."

(TRUTH-IN-REPORTING: Lewin is a subsidiary of

UnitedHealth Group, a

huge for-profit health insurer) The reason

that some low-wage workers are expected to lose

jobs, as CBO also said, is that some employers

who are faced with penalties will pass along

those costs to workers in the form of lower

wages or reduced benefits. For low-wage workers,

their wages can’t be reduced below the minimum

wage, so those firms would hire less, lay off

workers or use more part-time employment.

Sheils notes that there will be

distributional effects, as some sectors gain

jobs and others lose them, but the people

gaining employment aren’t necessarily the same

who lost jobs. He says there’s "a potentially

painful process here in changes in employment in

some industries … versus others." Skilled

workers are likely to benefit.In Nov 2009 the

House was debating a health care bill with

tougher requirements and penalties for employers

than the law now has. Even under that bill,

Elizabeth McGlynn, associate director of the

health unit at RAND Corp., told us the effect on

jobs "is likely to be quite minimal." McGlynn

said: "Most large businesses already offer

health insurance. And most small businesses are

excluded from the mandate. So it’s relatively

few firms that will be affected."

And small

businesses — those with 50 or fewer employees —

are likely to benefit under the law, Sheils

says. "I think they actually could come out

ahead," he says. "They don’t face the mandate

and they could get a tax credit at least for a

while for their health benefit. … It gives them

an advantage in the marketplace," if they’re

competing against larger firms.

Besides Sheils’ numbers and CBO’s

estimate, no other nonpartisan figures on the

law’s impact on jobs have been found. When

Sheils was

asked if he knew of others, he said

no. He added that he thinks that a lot of

economists believe the effect is small, and

that’s why they’re not doing an analysis.

1.6 million lost jobs?

The second

piece of evidence offered by the GOP report is a

study by the National Federation of Independent

Business, projecting a 1.6 million job loss. But

here the GOP misrepresents the evidence again.

The NFIB did not study the new law. Its report

was based on a hypothetical employer mandate

that bears little resemblance to what was

actually passed — and it also projects a gain of

hundreds of thousands of health care and

insurance industry jobs.

House GOP Leadership, January 6: A

study by the National Federation of

Independent Businesses (NFIB), the nation’s

largest small business association, found that

an employer mandate alone could lead to the

elimination of 1.6 million jobs between 2009

and 2014, with 66 percent of those coming from

small businesses.

That

refers to

a study by the NFIB’s Research Foundation.

But that study was issued

January 26, 2009 — well over a year

before the new law was actually enacted. NFIB

has not issued any study of what actually became

law, and one of this study’s authors, Michael

Chow, told us by e-mail that it has no present

plans to do so.

The GOP

report refers to the NFIB’s analysis as

"independent," but it’s hardly a neutral source.

The federation is

currently backing repeal of the new law, and

has historically been opposed to any requirement

that businesses provide coverage for their

workers. NFIB also

cosponsored with the Chamber of Commerce an

ad criticizing health care legislation in 2009.

More

important, what the NFIB foundation studied was

not what became law. It gave its estimate of the

effect of a hypothetical employer mandate that

would cover all businesses, and require that

they pay at least half the insurance premiums

for their workers.

NFIB Research Foundation, January 26, 2009:

[T]he employer mandate would cause the economy

to lose over 1.6 million jobs within the first

five years of program implementation. Small

firms would be most adversely affected by the

mandate and account for approximately 66

percent of all jobs lost.

Even if

that 1.6 million figure were accurate, it

wouldn’t apply to the new law that was signed

last March. The

new law does not require all businesses to

provide coverage. It exempts those with 50 or

fewer workers. So the "small firms" that the

NFIB study says would be "most adversely

affected" by the imaginary mandate studied in

2009 will not be affected at all by the actual

law. The 1.6 million figure is a gross

exaggeration of the likely effect of the law,

even using the NFIB’s study as a guide.

Looking

closely at the study. It’s not possible to say

precisely how big a job loss it would have

predicted had the 50-worker exemption been

factored in. It predicts that the mandate would

cause 467,182 jobs to be lost in firms employing

19 or fewer workers, so the 1.6 million figure

is high by at least that much. (See Table 6,

page 17.) In addition, the study estimates that

420,600 jobs would be lost in firms employing

from 20 to 99 workers, so some large but unknown

share of those would also have to be subtracted,

possibly reducing the figure to 1 million or

less.

And

although neither the NFIB nor the GOP leadership

report mentions it, this is a gross figure, not

a net figure. It fails to account for job gains

brought about by the new law, a point already

mentioned. And buried deep in the NFIB’s own

report is evidence that those job gains could be

substantial.

890,000 New Jobs?

Here’s

what the NFIB report said about job gains, on

page 20:

NFIB Research Foundation, January 26, 2009:

The employer mandate would boost demand for

healthcare goods and services, thereby

increasing employment in healthcare-related

sectors. The number of ambulatory healthcare

professionals (physicians, dentists, and other

healthcare practitioners) needed will increase

by 330,000. An additional 327,000 staff will

be required to work in hospitals. Some 157,000

more nurses (net of retirements) will be

needed to staff doctors’ offices, outpatient

clinics, and other provider locations. And

payrolls at insurance companies will expand by

76,000 workers.

That comes

to 890,000 new jobs.

Although

the new law relies more on an individual mandate

— requiring nearly everybody to obtain coverage

on their own if their employers don’t provide it

— the resulting increase in demand for health

care services, prescription drugs and other

goods would be the same. To repeat, CBO

estimates that the law will result in 32 million

additional persons with health coverage.

The NFIB

study cautioned that some of those 890,000 new

jobs might not be filled right away if the

increased demand outstrips the health care

system’s ability to meet it. But even so, it

amounts to a sizeable offset to the jobs likely

to be lost due to the employer mandate.

For the

record, conservatives aren’t the only ones

misrepresenting the law’s likely impact on jobs.

The

White House claimed in a blog post Jan. 7

that the law "could create more than 300,000

additional jobs" by "slowing the growth of

health care costs." The liberal Center for

American Progress said in

a January 2010 report that "health care

reform could increase the number of jobs in the

United States by about 250,000 to 400,000 per

year over the coming decade." But it remains to

be seen whether the law will actually slow the

growth of costs for employers and individuals,

as the White House hopes it does.

Budget-Busting?

So what about the "budget-busting"

label that House Republicans are also trying to

apply?

The Congressional Budget Office

officially scored the new law as self-financing,

projecting that it would actually reduce

the deficit over the first 10 years — and

beyond. And so it should surprise nobody

that

CBO

said Jan. 6 that repealing the new law, as

Republicans propose, would increase the deficit.

CBO’s latest figures project that repealing the

new law will increase the deficit by a total of

$230 billion over the next 10 years (through

fiscal year 2021). So keeping it in place would

help the budget, not bust it.

Republicans have a point, to this

extent: The CBO is forced by law to rely on

assumptions that may not turn out to be true,

and which Medicare officials say probably won’t

happen. The Medicare system’s chief actuary,

Richard Foster,

issued a report soon after passage of the

law saying much of the projected savings "may be

unrealistic," and that the law could cause 15

percent of hospitals to become unprofitable

unless Congress eases up. "If these reductions

were to prove unworkable within the 10-year

period 2010-2019 (as appears probable for

significant numbers of hospitals, skilled

nursing facilities, and home health agencies),

then the actual Medicare savings from these

provisions would be less," Foster said.

If that happens, the law could well

turn out to increase the deficit rather than

trim it. But that remains to be seen.

Sources

Congressional Budget Office. "The

Budget and Economic Outlook: An Update."

Aug 2010.

Republican House leadership. "Obamacare:

A Budget-Busting, Job-Killing Health Care Law."

6 Jan 2011.

Chow, Michael J. and Bruce D.

Phillips. "Small

Business Effects of a National Employer

Healthcare Mandate." NFIB Research

Foundation. 26 Jan 2009.

Sheils, John, senior vice

president, The Lewin Group. Interview with

FactCheck.org. 7 Jan 2011.

U.S. House.

H.R. 2. Introduced 5 Jan 2011.

Congressional Budget Office. "Effects

of Changes to the Health Insurance System on

Labor Markets." 14 Jul 2009.

Novak, Viveca and Lori Robertson. "Health

Care and the Economy." FactCheck.org. 17 Nov

2009.

"Small

Business Looks to the New Congress to Repeal the

Healthcare Law." NFIB website, accessed 7

Jan 2011.

Cutter, Stephanie. "Repealing

the Affordable Care Act will Hurt the Economy."

WhiteHouse.gov. 7 Jan 2011.

House of Representatives Committee

on the Budget, GOP staff. "The

Budgetary Consequences of the President’s Health

Care Overhaul." accessed 7 Jan 2011.

Congressional Budget Office. "Preliminary

Analysis of H.R. 2, the Repealing the

Job-Killing Health Care Law Act." 6 Jan

2011.

Foster, Richard. "Estimated

Financial Effects of the ‘Patient Protection and

Affordable Care Act,’ as Amended." Centers

for Medicare and Medicaid Services. 22 Apr 2010.

back to

top

Repeal

of PPACA is the REAL Job-Busting Action

A Republican plan to

sharply cut federal spending this year

would destroy 700,000 jobs through 2012,

according to an independent economic

analysis was released on Monday, February

28, 2011

The rep ort, by

Moody's

Analytics chief economist Mark Zandi,

offers fresh ammunition to Democrats seeking

block the Republican plan, which would terminate

dozens of programs and slash federal

appropriations by $61 billion over the next

seven months. Zandi, an architect of the

2009 stimulus package who has advised both

political parties, predicts that the GOP package

would reduce economic growth by 0.5 percentage

points this year, and by 0.2 percentage points

in 2012, resulting in 700,000 fewer jobs by the

end of next year. His report comes on the heels of a similar

analysis last week by the investment bank

Goldman Sachs, which predicted that the

Republican spending cuts would cause even

greater damage to the economy, slowing growth by

as much as 2 percentage points in the second and

third quarters of this year. Zandi also

had bad news for liberal Democrats who are

resisting sharp spending cuts: Bringing deficits

down to sustainable levels will require more

than a growing economy. Even if the economy

recovers as expected, he writes, lawmakers will

have to cut about $400 billion a year through

the rest of this decade to narrow the gap

between spending and revenue, and stop adding

significantly to the national debt. ort, by

Moody's

Analytics chief economist Mark Zandi,

offers fresh ammunition to Democrats seeking

block the Republican plan, which would terminate

dozens of programs and slash federal

appropriations by $61 billion over the next

seven months. Zandi, an architect of the

2009 stimulus package who has advised both

political parties, predicts that the GOP package

would reduce economic growth by 0.5 percentage

points this year, and by 0.2 percentage points

in 2012, resulting in 700,000 fewer jobs by the

end of next year. His report comes on the heels of a similar

analysis last week by the investment bank

Goldman Sachs, which predicted that the

Republican spending cuts would cause even

greater damage to the economy, slowing growth by

as much as 2 percentage points in the second and

third quarters of this year. Zandi also

had bad news for liberal Democrats who are

resisting sharp spending cuts: Bringing deficits

down to sustainable levels will require more

than a growing economy. Even if the economy

recovers as expected, he writes, lawmakers will

have to cut about $400 billion a year through

the rest of this decade to narrow the gap

between spending and revenue, and stop adding

significantly to the national debt.

"Significant

government spending restraint is vital, but

given the still halting economic recovery, it

would be counterproductive for that restraint to

begin until the economy is creating enough jobs

to bring down the still very high unemployment

rate," Zandi writes.

"Shutting the

government down for any length of time would

also be taking a big chance with the recovery,

not only because of the disruption to government

services, but also due to the potential hit to

the fragile collective psyche."

A partisan brawl is also brewing over the

legal limit on government borrowing, currently

set at $14.3 trillion. In his new report, Zandi

predicts that the U.S. Treasury will be able to

manage the government's finances under that cap

only until June. With Republicans lining up

against an increase, Zandi writes that the

"threat of a serious

policy misstep in the next several weeks and

months" is serious.

back to

top

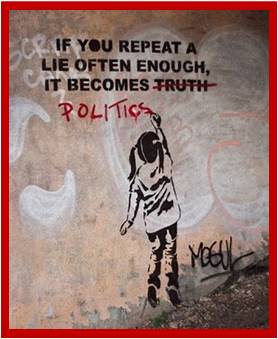

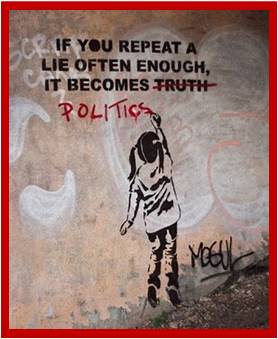

The Biggest and

Baddest Lies about PPACA ("Obamacare")

I

have been working on a compilation of the

many lies and distortions about PPACA that

have, in many cases become viral on the

Internet. And while most of them are, to the

rational mind at least blatantly and

bold-facedly outright lies, their

repetition, particularly by the likes of

Glenn Beck, Rush Limbaugh, Sean Hannity and

Bill O’Reilly have embedded them as apparent

“truths” in the collective conscience of the

Tea-Party and those who have fallen for the

lie.

My list is

not-comprehensive¸ and is still a work in

progress. The list will be updated and

expanded, but as of this haze-filled

morning, here it is:

Lie #1

– “Obamacare will result in the largest

tax hikes in the history of America.

Ordinary taxpayers will see their taxes

‘skyrocket.’" The liars who make

this statement go even further, saying:

“The top income tax rate will rise from 35

to 39.6 percent.... The lowest rate will

rise from 10 to 15 percent. All the rates in

between will also rise. Itemized deductions

and personal exemptions will again phase

out, which has the same mathematical effect

as higher marginal tax rates.” The liars

base their conclusion on the scheduled

expiration in 2011 of the 2001 and 2003

“Bush tax cuts” which a then

Republican-controlled Congress established

as a means of getting around Congressional

rules on reporting the actual costs of any

new legislation. By having the tax cuts

“expire within 10 years” they did not have

to account for the deficits these cuts

created in the federal budget. The liars

“assume” that Democrats will simply allow

ALL the tax cuts to expire. The fact is that

Democrats have repeatedly said that they

want only the top end tax cuts, those on

individuals earning more than $200,000 a

year and couples earning more than $250,000,

to expire. The tax cuts on lower incomes

will be extended and made permanent. So,

unless “ordinary” Americans is defined to

include those earning in excess of $200,000

a year, the statement is a lie.

Lie #2

– “Obamacare has a second "wave" of tax

increases taking effect January 1, 2011 that

impact “ordinary” Americans.” But

this "wave" consists of three relatively

minor tax changes that affect relatively few

people.

·

The so-called

"Obama Medicine Cabinet Tax" simply aligns

rules governing health savings accounts

(HSAs), Flexible Spending Arrangements

(FSAs) and Health Reimbursement Arrangements

(HRAs) with the tax rules that apply to

deducting medical expenses generally. Under

current law, taxpayers in general are not

allowed to deduct the cost of

non-prescription drugs as a medical expense.

The only exception is for insulin. But those

with

HSAs, FSAs and HRAs were allowed to

use pre-tax dollars to buy aspirin,

over-the-counter cold and allergy

medications, and other drugs available

without a doctor’s prescription. The new

"tax" simply says HSAs, FSAs and HRAs can’t

be used to buy these medications -- except

for insulin -- after December 31. This will

affect a small proportion of taxpayers. For

example, the health insurance industry says

10 million persons were covered by HSAs as

of January of this year, roughly 3.2 percent

of the population. For that relatively small

group, the change does amount to a tax

increase. It will bring in a total of $5

billion over the next 10 years.

·

The "HSA

withdrawal tax hike" refers to a doubling of

the current 10% penalty that must be paid on

any HSA funds spent for something that’s not

a qualified medical

expenditure. This is expected to

bring in $1.4 billion over 10 years.

·

The "special

needs kids tax" refers to a cap of $2,500

that the new law places on spending from

FSAs. The argument made is that "many"

families with special needs children now use

FSAs to pay tuition at private schools

catering to special needs children, schools

that Obama’s opponents say "can easily

exceed $14,000 per year." Perhaps so.

IRS rules do allow use of FSA funds to pay

for such expenses with pre-tax dollars. But

the liars who make this statement offer no

evidence of how many families might be

taking advantage of this tax break

currently. Indeed most employers offering

FSA plans already limit the amount that can

be set aside tax-free, to $2,500-$4,000. The

claim is copied from the website of

Americans for Tax Reform, but as ATR itself

says: "For most people, the $2500 cap

won’t be noticed." As ATR concedes, FSAs

"tend to be used for things like small

deductibles, co-payments, eyeglasses,

over-the-counter medicines, and laser eye

surgery." The amount deferred in the

typical FSA is probably much less than

$2,500 today, ATR says. The Congressional

Budget Office expects the change will bring

in $13 billion over 10 years, but says

nothing about how much of that is likely to

come from the pockets of parents of special

needs children.

Without

arguing for or against any of these three

tax increases. I simply point out that, even

taken together, they amount to less than $2

billion per year and, therefore, don’t

constitute anything close to a "wave" of

historically large tax increases taking

effect next year.

Lie #3

– “Obamacare provides for armed IRS

agents to enforce penalties.” This is a

fantasy. Tea-Party lawmakers are claiming

the law might require “as many as 16,500”

new jobs in the IRS, a figure inflated by

dubious assumptions. But the agency’s role

will be mainly to hand out tax credits, not

to enforce penalties. And the IRS won’t be

sending armed agents to enforce the health

care mandate, as falsely claimed by Texas

Tea-Party Congresscritter Ron Paul. The law

specifically waives any criminal penalties

for those who both decline to obtain

insurance coverage and refuse to pay the tax

enacted to penalize lack of coverage.

Lie #4

– “Failure to purchase insurance will

result in ‘jail time” for

offenders.” This is another

bold-faced lie perpetuated over and over

again by the laws’ opponents, and especially

prevalent among Fox News commentators and

guests. The Facts: The law has a

specific provision: "In the case of any

failure by a taxpayer to timely pay any

penalty imposed by this section, such

taxpayer shall not be subject to any

criminal prosecution or penalty with respect

to such failure,"

which prohibits criminal prosecutions (and

any possible “jail time.” Fox News

reluctantly and belatedly admitted this

truth. But Fox News’ Bill O’Reilly, trying

to defend himself and his network from this

allegation, went so far as to suggest that

“no one on Fox News had ever suggested that

there would be jail time.” That statement

was debunked by numerous news agencies

citing more than 40 instances when Fox News

commentators and guests lied about jail

time, with at least 3 of these coming from

Bill O’Reilly himself. See, for example:

http://www.politifact.com/truth-o-meter/statements/2010/apr/27/bill-oreilly/oreilly-says-no-one-fox-raised-issue-jail-time-not/

Lie #5

– “The law set up a "private army" for

Obama.” The facts: The liars who make

this statement refer to a provision in the

new law that establishes a Ready Reserve

Corps of doctors and other health care

workers who can be called upon in the case

of a public health emergency. E-mails that

call them "Hitler youth" and speculate that

they may be administering "lethal

injections" are thoroughly false and

malicious.

Lie #6

-- “A government committee will decide

what treatments you will receive."

The facts: The liars who make this statement

refer to a provision in the new law that

establishes a "private-public advisory

committee" that will "recommend" what

minimum benefits would have to be

included in the basic insurance

package that would meet the program’s

“mandate” for coverage. There is nothing in

the law that limits an individual from

coverage of more extensive benefits nor is

there a government panel which will review

each individual’s treatments.

Lie #7

-- "Non-US citizens, illegal or not, will

be provided with free healthcare services."

The facts: The liars who make this statement

refer to a provision in the new law that

prohibits discrimination in health care

based on "personal characteristics." Another

provision explicitly forbids "federal

payment for undocumented aliens" and further

prohibits undocumented individuals from even

using their own money to pay for coverage

through the insurance exchanges that will be

created by the new law.

Lie #8

-- “Muslim Americans are exempt from the

mandate to have health insurance.”

The law does say that some religious groups

may be considered exempt from the

requirement to have health insurance, and it

uses the definition from 26 U.S. Code

section 1402(g)(1), which defines the

religious groups considered exempt from

Social Security payroll taxes. Eligible

sects must forbid any payout in the event of

death, disability, old age or retirement,

including Social Security and Medicare. They

must also be approved by the Commissioner

for Social Security. The law was originally

designed to apply to the Old Order Amish,

and we have yet to find any cases in which

members of other religious groups were

successfully able to claim exemption.

The Muslim faith does not forbid purchasing

health insurance, and no Muslim group has

ever been considered exempt under the

definitions used in the health care law.

Lie #9

– “Under the new health care law, the

elderly will be denied care when they have

passed the age limit for treatment.”

The liars who make this statement are unable

to cite any provision, any reference, or any

speech, comment or off-the-record remark

from any of the bill’s sponsors or

supporters that justifies this conclusion.

Where can we start, there is absolutely

nothing in the new law, not a sentence, not

an inference, not a scintilla of evidence

that “age” would be a standard for care or

could become a standard of care. Some lies

are more bold-faced than others. This is one

of them.

Lie #10

– “A section about ‘Community-based Home

Medical Services’ is actually a payoff to

ACORN for its support of Obama."

The liars making this statement interpret

any reference to the word "community" to be

some kind of payoff for ACORN, a

“community-organizing” group long vilified

by President Obama’s opponents. ACORN does

not provide medical services, home or

otherwise, and there is no connection,

tangentially or otherwise. In truth,

“community-based home medical services” and

the development of “community-based health

centers” have been old pre-Tea Party

takeover Republican proposals as an

alternative to the more direct government

provision of care. Three times in the eight

years of President George W. Bush State of

the Union speeches, Bush called for

Congressional action on expanding

“community-based health centers.” This just

another good old pre-Tea Party takeover

Republican idea, incorporated into the new

law in an attempt to gain

bipartisan-support, that has been turned on

its head and is now evidence of Obama’s

socialism.

Lie #11 – “Every person

will be issued a National ID Healthcard.”

The liars who make this claim refer to a

provision that government standards for

electronic medical transactions "may

include utilization of a machine-readable

health plan beneficiary identification

card,” to show eligibility for services.

Insurance companies typically issue such

cards already, but if such a standard were

issued the cards would need to be in a

standard form readable by computers. The

word “may” is used to permit such a

standard, but it does not require one. There

is no mention of any “National ID

Healthcard” anywhere in the bill.

Lie #12

-- "The Obama Health and Human Services

Department is planning to compile a federal

health record on all U.S. citizens by 2014,"

including "each individual’s Body Mass Index."

The Facts: The liars who make this claim

refer to a provision in the new law that

directs the establishment of an “electronic

health record” (EHR) by 2014. Other liars

about the bill have cited this same

provision for all sorts of potentially

malevolent and nefarious actions by

government. Let’s set the record

straight: the broader use of electronic

“health information technology” (HIT) has

been a goal of both the private health care

industry, which formed a trade group the

“Association for Electronic Health Care

Transactions” (AFEHCT) in 1993 and the

government, which established the

quasi-government-private sector “Workgroup

on Electronic Data Interchange” (WEDi)

in 1991. This was the original brainchild of

Missouri pre-Tea Party takeover Republican

Senator Christopher Bond in 1989 and was a

major part of the Health Insurance

Portability and Accountability Act of 1996

(HIPAA). Some estimates say that better use

of HIT could result in savings of up to 30%

of the health care dollar. Computerizing

medical records has long been a goal of

policymakers across the ideological

spectrum. The idea is to shift from

paper-based records to electronic ones, so

that doctors can access information about

patients more quickly and easily and make

better clinical decisions as a result.

Supporters hope that electronic medical

records will reduce the frequency of medical

errors, unnecessary diagnostic tests and

inappropriate treatments. They also hope

that, in the long term, streamlining

record-keeping could bring down the rapidly

escalating cost of health care. As

noted, the effort did not begin with

President Barack Obama. At the

earliest President George H.W. Bush called

for more work in this area in 1991. In 2004,

his son, President George W. Bush issued an

executive order creating incentives for the

adoption of information technology by 2014,

to be spearheaded by a new federal official,

the national coordinator for Health

Information Technology. Under Obama,

Congress passed his economic stimulus

package in February 2009. The stimulus

included several items designed to promote

health information technology, including $19

billion over four years to fund electronic

infrastructure improvements and the

widespread adoption of electronic health

records by providers, typically through

higher Medicare and Medicaid reimbursements

for doctors who use electronic medical

records effectively. The Office of the

National Coordinator for Health Information

Technology describes the Nationwide Health

Information Network as a "network of

networks." Please note this is not a single

database residing at, say, a federal agency.

It's more accurately viewed as a network to

link many separate databases where records

already exist, such as regional databases or

medical offices, along with efforts to

establish common technical standards so that

these far-flung repositories of data can

exchange information as needed. So will an

intrusive government will have access to

your private medical information? The short

answer is: No. This is just another great

old pre-Tea Party takeover Republican idea

that has gone bad because it was embraced by

Democrats and President Obama. Just say NO

to anything President Obama says.

Lie #13 -- The

federal government will have direct,

real-time access to all individual bank

accounts for electronic funds transfer.”

The Facts: The liars who make this claim

refer to a provision that aims to simplify

electronic payments for health services, the

same sort of electronic payments that

already are common for such things as

utility bills or mortgage payments. The bill

calls for the secretary of Health and Human

Services to set standards for electronic

administrative transactions that would

"enable electronic funds transfers, in order

to allow automated reconciliation with the

related health care payment and remittance

advice." There is no mention of "individual

bank accounts" nor of any new government

authority over them. Also, the section does

not say that electronic payments from

consumers is required. Also, this section of

the law simply expands on the 1996 Health

Insurance Portability and Accountability Act

(HIPAA) which was originally proposed by

President George H.W. Bush in 1991 and which

was passed by a GOP-controlled Congress in

1996 and expanded by Republicans in 2004 and

2006. Just another good old pre-Tea

Party takeover Republican-idea gone bad

simply because Democrats also support it.

The Republican/Tea-Party “NO-machine” gone

amok.

Lie #14 – “Taxpayers

will subsidize all union retiree and

community organizer health plans (read:

SEIU, UAW and ACORN).” The liars who

make this claim refer to a provision that

would set up a new federal reinsurance plan

to benefit retirees and spouses covered by

any

employer plan, not just those run by

labor unions or nonprofit groups.

Specifically, it covers “retirees and . . .

spouses, surviving spouses and dependents of

such retirees” who are covered by

“employment-based plans” that provide health

benefits. It’s open to any “group health

benefits plan that . . . is maintained by

one or more employers, former employers or

employee associations,” as well as voluntary

employees’ beneficiary associations .

Furthermore, the aim of the fund is to cut

premiums, co-pays and deductibles for the

retirees. Payment “shall not be used to

reduce the costs of an employer.” Since this

provision went into effect, thousands of

corporations, including some of the nation’s

largest employers, have applied for

coverage.

Lie #15 – “All

private healthcare plans must conform to

government rules to participate in a

Healthcare Exchange.” The liars

who make this claim are trying to draw

negative inferences from a provision in the

new law setting up new state and regional

Health Insurance Exchanges through which

individuals and employers may choose from a

variety of private insurance plans, much

like the system that now covers millions of

federal workers. Any private insurance plans

offered through this exchange must meet new

federal standards. For example, such plans

can’t deny coverage for preexisting medical

conditions.

Lie #16

– “All private healthcare plans must

participate in the Health care Exchange

(i.e., total government control of

private plans.)” This is yet

another “good” old pre-Tea Party takeover

Republican idea gone bad because Democrats

“stole” it. Health Exchanges have long

been operational in two US states, Utah and

Massachusetts. Under the Utah Health

Exchange, operational for over 10 years and

established by a Republican-controlled

legislature and endorsed by Republican

governors and local business owners, most

Utahans get their health coverage through

the Exchange which assures basic standards

and operational mandates. In Massachusetts,

the state’s “Connector” was and is an

integral part of the “Romneycare” plan

mandating coverage for every state

resident. Under the Obama

version, no insurance company is required to

sell plans through an exchange if it doesn’t

want to. Any employer may choose to buy

coverage elsewhere. In fact, the vast

majority of employers will still be buying

private plans through the normal

marketplace, because only employers with 100

or fewer employees are even allowed to buy

through an exchange in the first year. It

won’t be until 2017, that the exchanges will

be open to all employers.

Lie #17 – “Members

of Congress have exempted themselves from

coverage under the law.” Au contraire,

Contrary to all rumors suggesting that

members of Congress are NOT covered by the

new law, the law specifically requires that

members of Congress MUST buy their coverage

through an Exchange. Quote: "The

only health plans that the Federal

Government may make available to Members of

Congress and congressional staff with

respect to their service as a Member of

Congress or congressional staff shall be

health plans that are — (I) created under

this Act (or an amendment made by this Act);

or (II) offered through an Exchange

established under this Act (or an amendment

made by this Act)."

Lie #18

– “The new law cover Viagra for convicted

sex offenders.” The facts: There’s no

change from current law. Convicts who are

not in prison can purchase whatever health

plan they’d like and some plans could cover

erectile-dysfunction drugs. The

Congressional Research Service said that

there was nothing in the new law that would

"require health plans to limit the type of

benefits that can be offered based on the

plan beneficiary’s prior criminal

convictions." This mini-controversy erupted

when Republicans introduced a string of

amendments in a final effort to obstruct

passage of the reconciliation bill.

Republican Sen. Coburn of Oklahoma proposed

the amendment to bar sex offenders from

getting health plans that covered such drugs

with federal money through the state-based

exchanges. Democratic Sen. Max Baucus of

Montana called the amendment "a crass

political stunt." And it failed by a 57-42

vote.

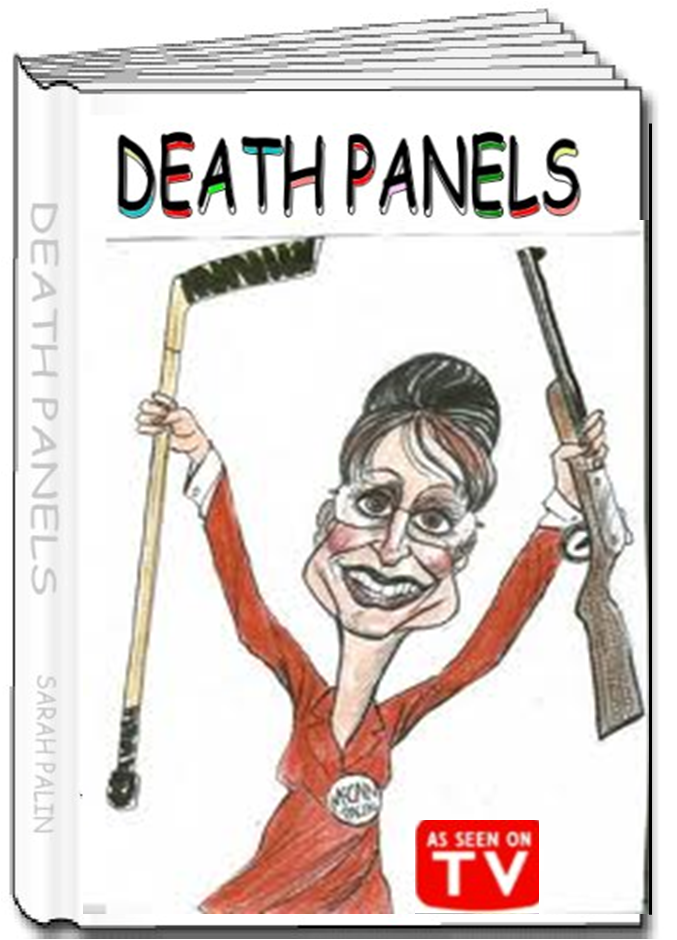

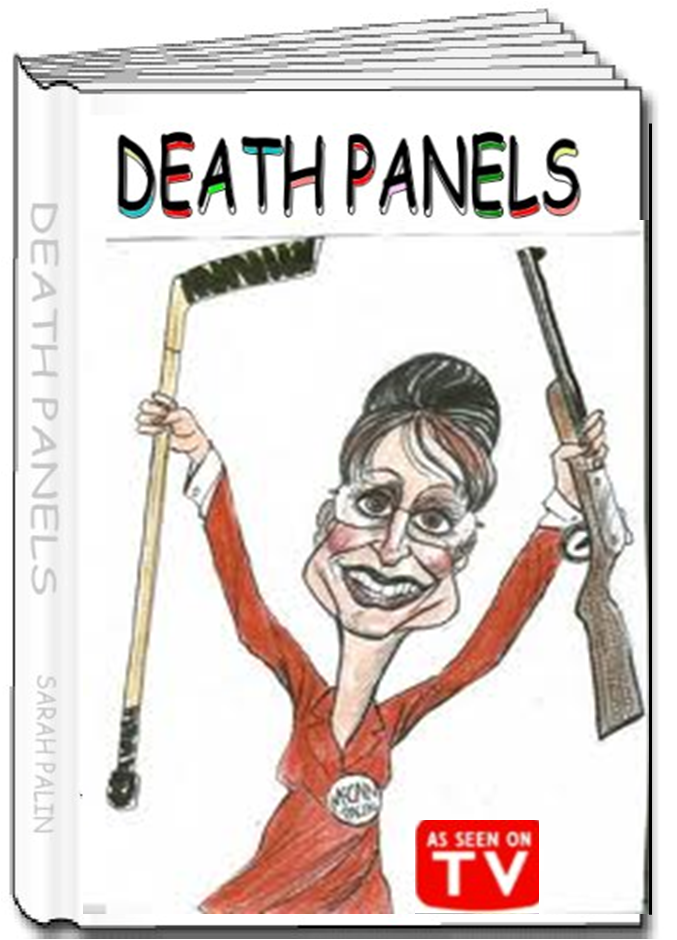

AND THE

BIGGEST, BADDEST LIE ABOUT PPACA OF ALL: “It

will “kill granny” (and impose health care

rationing) --

Trust me on

this, I’m a lawyer… just like his Democratic

predecessor in the presidency, Bill Clinton,

who was somewhat successful at reaching

across the aisle, President Barack Obama has

not hesitated to “steal” a good old pre-Tea

Party Republican ideal and turn it to good

(political) use. Republicans (without a

single Democratic vote) passed the “Medicare

Modernization Act of 2003.” Buried in that

717-page law were provisions for CM2 to

begin the process of determining the

“comparative effectiveness” of various

health care services. The current health

care plans simply build on that initial

step… but oops, that’s where Sarah Palin’s

“death panels”

and “killing granny” became an issue.

The GOP-passed 2003 Medicare Modernization

Act (better known for establishing the Part

D drug program) had lots of buried secrets,

not the least of which was new funding for

AHRQ and a plan to begin several

demonstration projects with a goal of better

identifying:

•

“the appropriate use of

best practice guidelines

by providers and services by beneficiaries”

•

The

“reduced scientific uncertainty”

in the delivery of care through the

examination of

variations in the utilization

and

*allocation

of services, and outcomes measurement

and research”

•

achieving the

“*efficient

allocation of resources”

•

“the financial effects on the health care

marketplace of altering the incentives for

care delivery and changing the

*allocation of resources”

(*

Trust me on this, I’m a lawyer, “allocation

of resources” = “rationing”)

The little agency that could. Buried in the

backwater reaches of the U.S. Public Health

Service is the Agency for Healthcare

Research and Quality (AHRQ), charged with

developing the future “cookbook of health

care.”

CM2 has already embarked on an

effort to define many of the elements of

effective health care, that is what works

and what doesn’t, using much of the work

product of AHRQ.

“In the future, we will only pay for what

works and not for what doesn’t work.”

President George W. Bush, September 17, 2006

Lies and the Big Fat Liars that Tell Them

back to

top

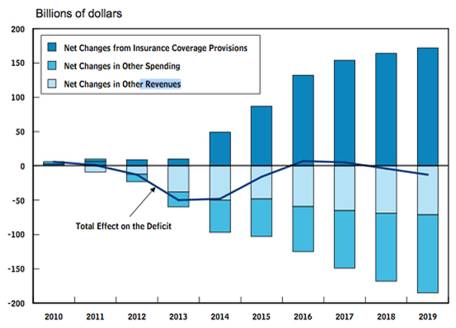

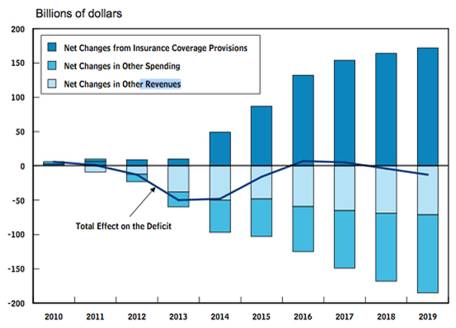

The budgetary impact of the new health

care reform law over 10 years and beyond.

Considerable debate has focused on the ACTUAL effects

the recently enacted health reform legislation (PPACA) would have on

the federal budget. TeaParty/Republicans, led by their new majority

leader, Eric Cantor, have been particularly vocal in reinforcing their

demand that the new law be repealed IN ITS ENTIRETY. Democrats have

countered citing the reports from both the nonpartisan Congressional

Budget Office (CBO) and the bipartisan Joint Committee on Taxation

(JCT).

Let's begin by reviewing the

budget estimates done

by CBO and the staff of the Joint Committee on Taxation (JCT):

In combination, the initial legislation and the

subsequent reconciliation act that modified it will generate changes

in direct spending and revenue that will reduce federal deficits by

$143 billion during the 2010-2019 period. The legislation will change the size of the federal

budget by increasing outlays by $411 billion and revenues by $525

billion over the next 10 years (excluding the provisions of the

reconciliation act related to education, which will reduce spending

by about $19 billion over that period). The legislation will

increase the federal budgetary commitment to health care (the sum of

net federal outlays for health programs and tax preferences for

health care) by $390 billion over the next 10 years. The legislation

will reduce federal deficits during the decade beyond the 10-year

budget window relative to those projected under current law—with a

total effect in a broad range around one-half percent of GDP. But are these assumptions valid? Eric Cantor of the

TeaParty/GOP says: "About the budget

implications, I think most people understand that the CBO did the job

it was

asked to do by the then-Democrat majority, and it was really comparing

apples to oranges. It talked about 10 years' worth of tax hikes and

six years' worth of benefits. Everyone knows beyond the 10-year

window, this bill has the potential to bankrupt this federal

government as well as the states."

We can conclude then, if Congresscritter Cantor is correct, that the

CBO is not the non-partisan body we have been led to believe

and is simply another partisan hack group, which we should be free to

ignore any time its conclusions threaten our pre-conceived notions.

Aw shucks, before we go that far, let's look at some

of Mr. Cantor's objections:

He has asserted that CBO and JCT have misestimated

("misunderestimated?) the effects of the changes in law,

particularly underestimating the costs of the program subsidies to

low and middle income families.

But, if you look at the tables and the statistics

relied upon by the CBO and JCT, you can see that they have chosen some

fairly expansive numbers, reflecting the middle of the distribution of

possible outcomes based on some pretty careful analysis and using

clearly professional judgment, drawing upon relevant research by other

experts. Of course, their estimates are just that, "estimates," and

the effects of comprehensive health care reforms at this early stage

are clearly very uncertain. Actual outcomes will surely differ from

the CBO and JCT estimates in one direction or another, but to insist

that the TeaParty/GOP estimates are the only ones that are correct and

that the other side's are a crock of you know what, is disingenuous at

best. (For the record, we should note that Democrats have criticized

the CBO estimates as being "too low" and "not fairly estimating the

larger impact the new law will have on budgetary savings). Looking at

the CBO and JCT estimates seems the safest middle ground.

Cantor

and the TeaParty/GOP have also asserted that the CBO and JCT budget

estimates hide or misrepresent certain effects of the law, such as

its impact on future discretionary spending, its effect on the

government’s ability to pay Medicare benefits, and its effects on

the economy, suggesting that these impact will be far greater that

suggested.

The CBO and JCT estimates focus on direct spending and revenues

because those are the figures that are relevant to the "pay-as-you-go

rules" that govern House spending legislation. PAYGO is the acronym

for House budget rules first adopted during the Newt Gingrich/GOP

years (post 1994) which were essentially abandoned during the George

W. Bush "borrow and spend" years and restored in 2006 when the

Democrats regained control of the House by a narrow 6-vote margin.

PAYGO rules require that any new spending be offset either by new

taxes or by cuts in spending elsewhere. To go around PAYGO, the House

would have had to pass additional legislation excepting the spending.

In the case of PPACA, the new taxes and spending offsets were

considered neutral and thus additional legislation was not required.

The additional spending suggested by Cantor and the TeaParty/GOP, that

the costs of implementing the new law, and the costs of maintain

physician reimbursement at non-BBA levels, should have invoked PAYGO

and thus demand repeal of the law, fall flat. (1) Administrative